Sign my petition to protect your Second Amendment rightsTake the SurveyPetition: End Illinois' Sanctuary State

Sign up for email updates

Thanks for signing up!

By submitting your information, you agree to receive official emails from State Representative Dave Severin. You can opt out at any time.

Recent News

Saturday, April 27, 2024

Today, independent bookstores across the nation will host special events to celebrate National Independent Bookstore Day. Join in the festivities by visiting your local independent bookstore today.

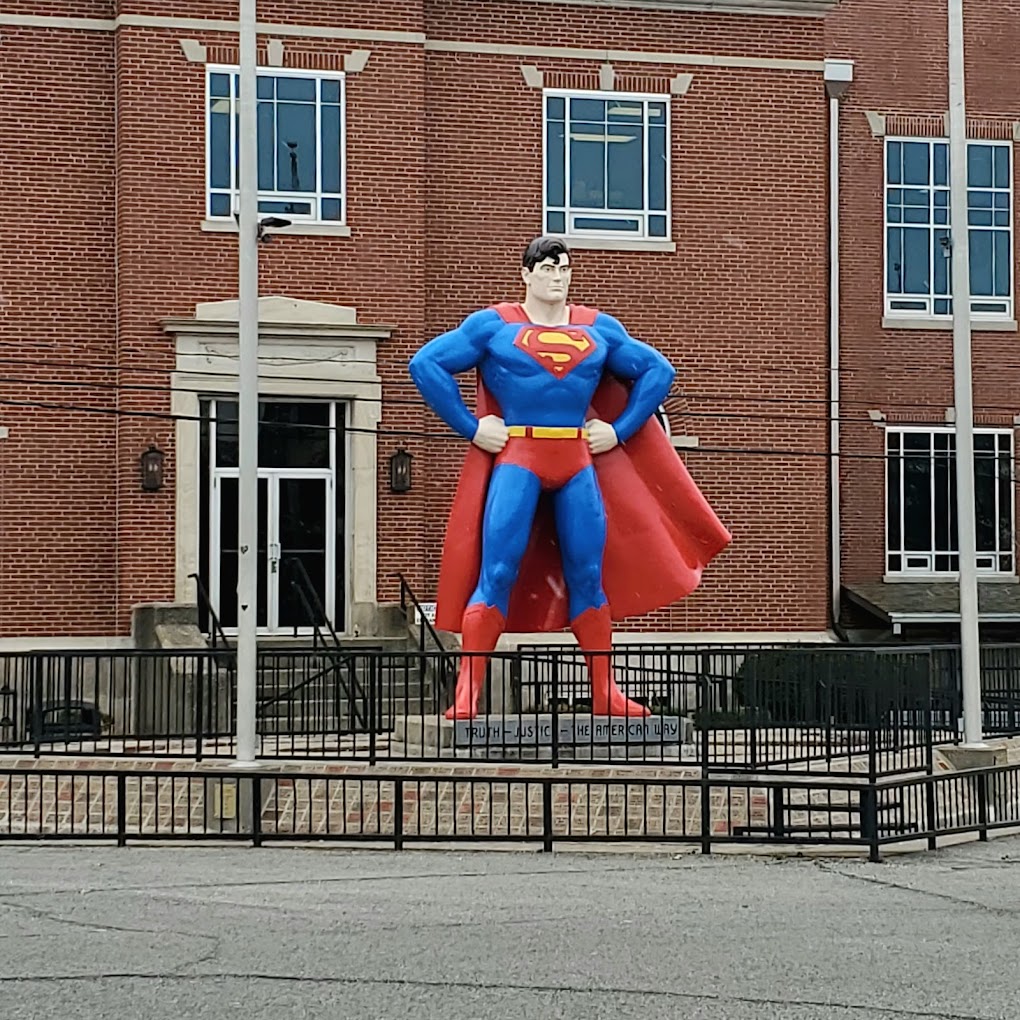

Friday, April 26, 2024

Created by Marvel Comics in 1995, National Superhero Day honors the real and fictional people who serve and protect us. Superheroes inspire the best in us all and remind us…

Friday, April 26, 2024

Arbor Day is a holiday dedicated to planting and appreciating trees for future generations. Trees are not only a beautiful part of nature, but they also provide critical materials and…

Videos

Latest Video